Ebrima Y. Jallow

2 mins read

As digital payments continue to rise in The Gambia, more people are hearing terms like mobile wallet and payment aggregator—often interchangeably. But they serve very different purposes in our financial ecosystem.

If you're a business owner, developer, or even just someone sending money to family, understanding the difference can help you choose the right platform—and avoid serious limitations down the line.

Let’s break it down.

What Is a Mobile Wallet?

A mobile wallet is a digital version of your physical wallet. It allows you to:

- Store money (like cash)

- Send or receive funds directly to/from other users

- Pay for services like data, electricity, or groceries at supported merchants

📱 Examples in The Gambia:

- Wave

- Afrimoney

- Qmoney

- Yoona

- APS

- NAFA

- etc

Typical Use Cases:

- Peer-to-peer transfers (e.g., sending D200 to a friend)

- Paying bills

- Buying mobile data or airtime

Mobile wallets are popular for their accessibility—even someone with just a basic smartphone can use them.

But here’s the catch: they don’t scale well for most businesses and business use cases.

What Is a Payment Aggregator?

A payment aggregator is a platform that allows businesses to accept multiple payment types (mobile money, cards, bank transfers) through a single integration.

They don’t store money like mobile wallets—they just move it from customer to business securely and instantly.

Examples in The Gambia:

- Waychit

- Gamswitch (via Bantaba App)

Who Are Payment Aggregators Built For?

Payment aggregators like Waychit are designed for businesses that need more than just basic transactions. Whether you're a restaurant, retailer, logistics firm, or government institution, they offer the tools to streamline operations, automate disbursements, and unify payment channels.

Common Use Cases:

- Retail & E-commerce: Accept Visa, Mastercard, mobile wallets, and bank payments through a single checkout.

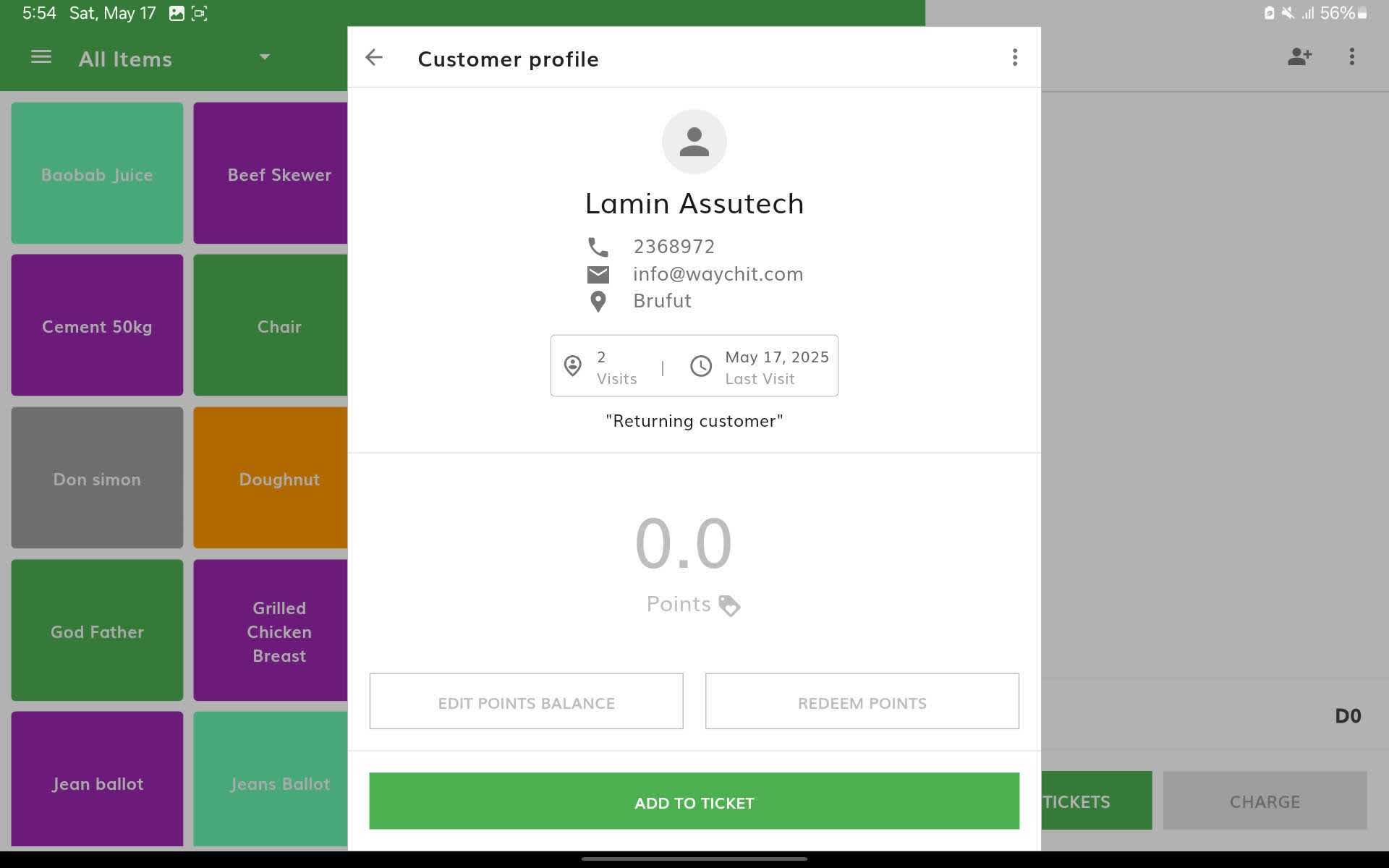

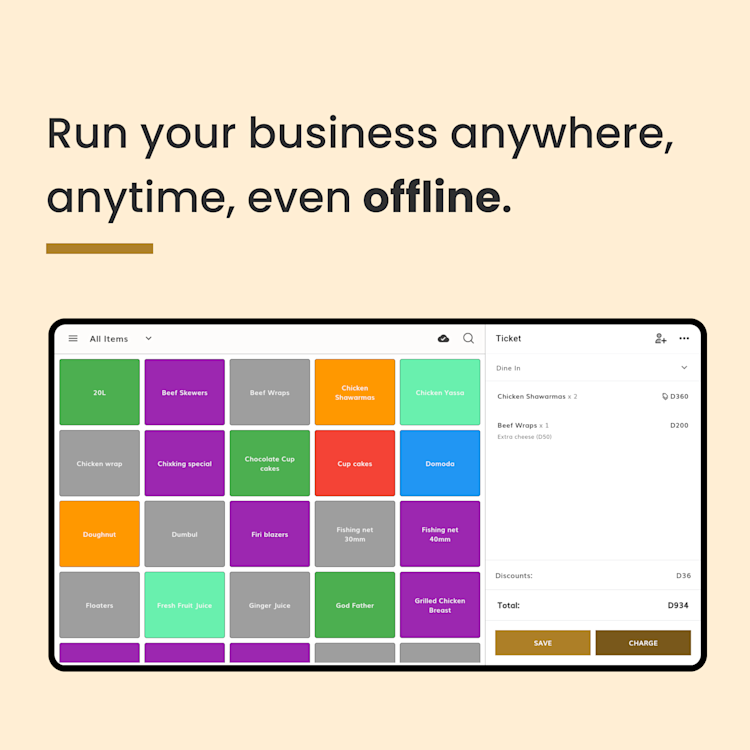

- Restaurants & Hospitality: Use integrated POS systems with kitchen printers, staff terminals, and real-time sync.

- Institutions: Disburse fuel, food, and insurance vouchers to staff in bulk, tracked and redeemed digitally.

- Utilities & Service Providers: Enable customers to pay bills online or via app, with instant confirmation and settlement.

With Waychit, Businesses Can:

- Centralize all payments — cards, banks, wallets — in one dashboard.

- Automate routine tasks like staff disbursements and invoice generation.

- Receive funds instantly, with no delays.

- Track payments, inventory, and performance — all in real time.

Key Differences at a Glance

| Feature | Mobile Wallet | Payment Aggregator |

|---|---|---|

| Peer-to-peer transfers | ✅ Yes | 🚫 No |

| Stores money | ✅ Yes | 🚫 No |

| Suited for businesses | 🚫 Limited | ✅ Yes |

| Accepts multiple payment types | 🚫 No | ✅ Yes |

| Instant bank settlements | 🚫 No | ✅ Yes |

| Developer APIs | ✅ Yes | ✅ Available |

| Card Payments | 🚫 No | ✅ Yes |

Why It Matters for Gambian Businesses

Imagine a restaurant that accepts only mobile money. What happens if a customer has a Visa card or wants to pay from their bank?

They leave. You lose a sale.

But with a payment aggregator like Waychit, you don’t have to choose. You can accept:

- Wave

- Afrimoney

- Qmoney

- Visa/Mastercard

- Ecobank transfers

- and more....

All from one interface, with instant settlement to your preferred account.

Final Thoughts

In The Gambia’s growing digital economy, mobile wallets and payment aggregators are both essential—but they solve different problems.

- Mobile wallets are great for everyday users.

- Payment aggregators like Waychit

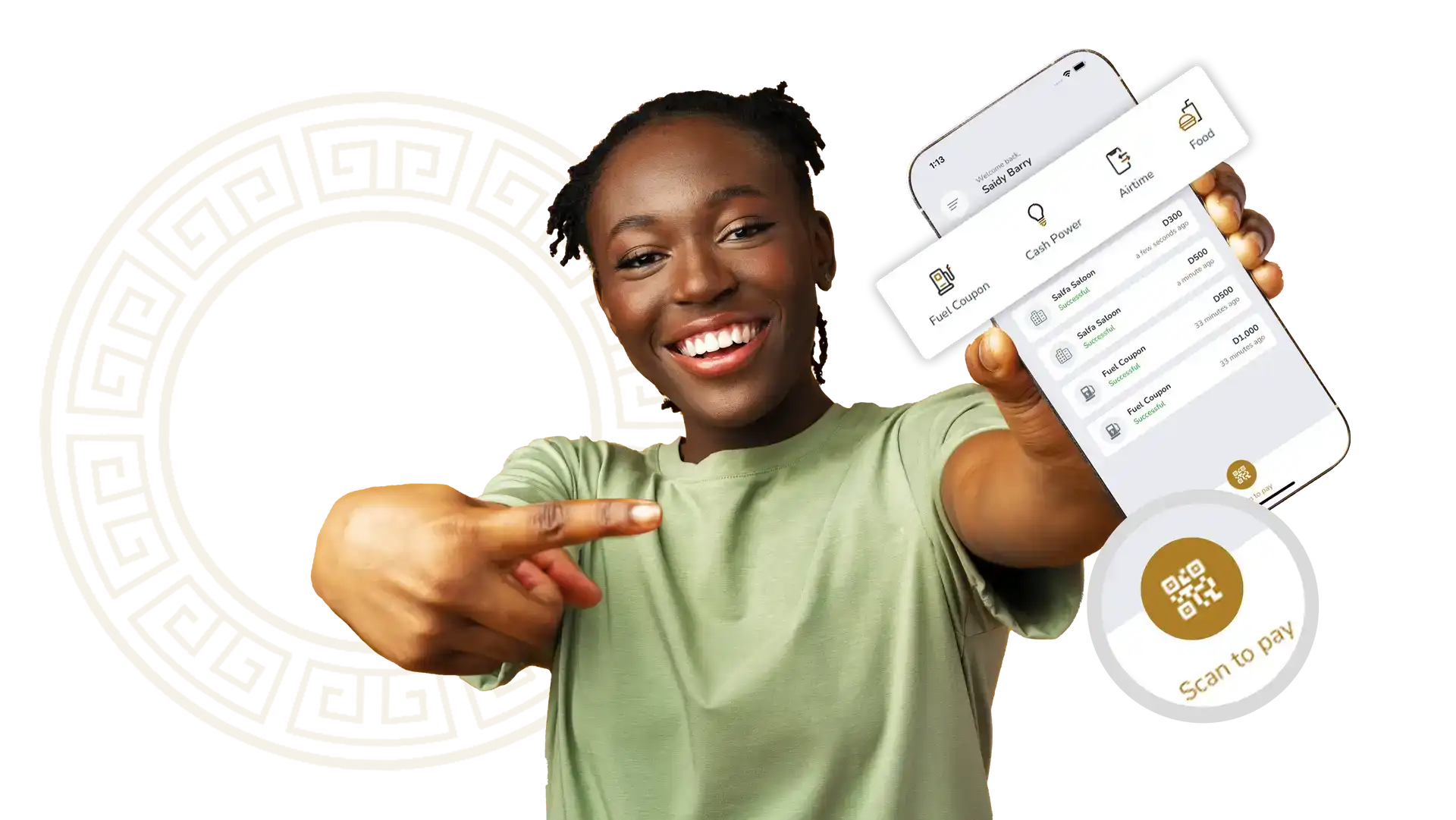

For Everyday Users:

- Pay for fuel, food, insurance, airtime, data, utility bills, school fees, and more — all in one app.

- Use your preferred payment method: mobile wallet, Visa/Mastercard, or bank account.

- Get instant receipts, real-time confirmations, and a growing list of partner locations.

For Businesses:

- Accept payments through any channel — cards, mobile wallets, or bank.

- Automate bulk staff disbursements (like fuel, airtime, data, and food vouchers).

- Use WaychitPOS for real-time inventory, staff terminals, and instant settlement.

- Access APIs, analytics, and a merchant dashboard for full control.

If your goal is to grow your business, improve customer experience, or streamline payments, a payment aggregator like Waychit is the way forward.

Ready to accept payments from anywhere in The Gambia?

Sign up here

Payment

Payment Aggregators