Ebrima Y. Jallow

3 mins read

The Gambia is currently witnessing an exciting fintech revolution. Innovative startups are reshaping the financial landscape, promoting financial inclusion, and fostering economic growth. However, behind this wave of innovation, there’s a complex interplay between regulatory measures, competition dynamics, the influence of established financial institutions, and, notably, Central Bank-backed Financial Institutions. In this blog post, we will delve into the world of fintech in The Gambia, exploring how regulations impact both emerging startups and established players, and whether they genuinely foster innovation or inadvertently favor big players.

The Rise of Fintech in The Gambia

Recent months have seen a blossoming fintech ecosystem in The Gambia. Local startups are leveraging technology and addressing the financial service gaps, especially for underserved communities. According to the UNCDF, in 2022, approximately 69% of the population remained unbanked. With the gradual adoption of telco-driven mobile money services, emerging mobile banking and digital payment platforms have made financial services more accessible than ever. While the increased availability of financial services is a significant development, the efficacy and security of these services within the framework of established regulations is of paramount importance.

Regulatory Framework in The Gambia

Fintech, like any other industry, is not immune to regulation, and for valid reasons. Regulations are designed to safeguard consumers and ensure the stability of the financial sector. In The Gambia, the Central Bank plays a pivotal role in shaping the regulatory landscape, with the goal of striking a balance between fostering innovation and preserving the integrity of the financial system.

Balancing Innovation and Regulation

However, a fundamental question arises: Can regulation potentially stifle the fintech revolution in The Gambia? Should regulatory authorities also double as competitors to existing financial institutions? Some argue that excessive regulatory burdens can discourage startups, potentially leading to consolidation instead of healthy competition. Nevertheless, it is crucial to recognize that regulations provide essential consumer protection and safeguards against financial instability. An intriguing scenario emerges when regulatory bodies become affiliated with financial institutions, further raising questions about a potential conflict of interest. A case in point is the Central Bank of The Gambia and its affiliate financial institution, Gamswitch. This raises concerns about the impartiality of regulatory bodies in an industry they are meant to oversee.

Challenges of Fintech Regulation

Regulation is often met with dread, sometimes with good reason, due to several key challenges:

-

Rapid Technological Evolution: Fintech evolves faster than regulatory bodies can keep up, leading to potential mismatches between laws and industry practices.

-

Lack of Technical Expertise: Regulatory bodies may lack the required technical expertise, resulting in well-intentioned but impractical regulations that hinder innovation.

-

Influence of Non-Technical Personnel: Regulatory agencies may employ individuals with financial industry experience in non-technical roles, contributing to regulatory challenges.

-

Slow Regulatory Processes: Slow regulatory decision-making can lead to a misalignment between laws and industry realities.

Regulatory Capture

Regulatory capture is a phenomenon where regulatory agencies, intended to act in the public interest, end up serving the interests of the industries they regulate. This can occur due to various factors, including industry lobbying, revolving doors between government and industry, and the limited resources and expertise of regulatory agencies. Regulatory capture can lead to regulations that favor established players, potentially stifling competition and innovation.

Regulatory capture is a phenomenon where regulatory agencies, intended to act in the public interest, end up serving the interests of the industries they regulate.

The Bottom Line

At the core of fintech in The Gambia is the pursuit of financial inclusion. Fintech has the potential to bring financial services to unbanked and underbanked populations, promoting economic growth and reducing inequality. It is imperative that regulations support this mission. To achieve this, startups, regulators, and established financial institutions must collaborate to create a regulatory framework that nurtures innovation, fosters competition, and safeguards consumers.

The future of fintech regulation in The Gambia is still unfolding. Striking the right balance between innovation and regulation is essential. This requires creating an environment where startups can innovate, financial inclusion can be realized, and consumers are protected. It’s a complex dance, but with the right steps, The Gambia can lead the way in fintech innovation in Africa.

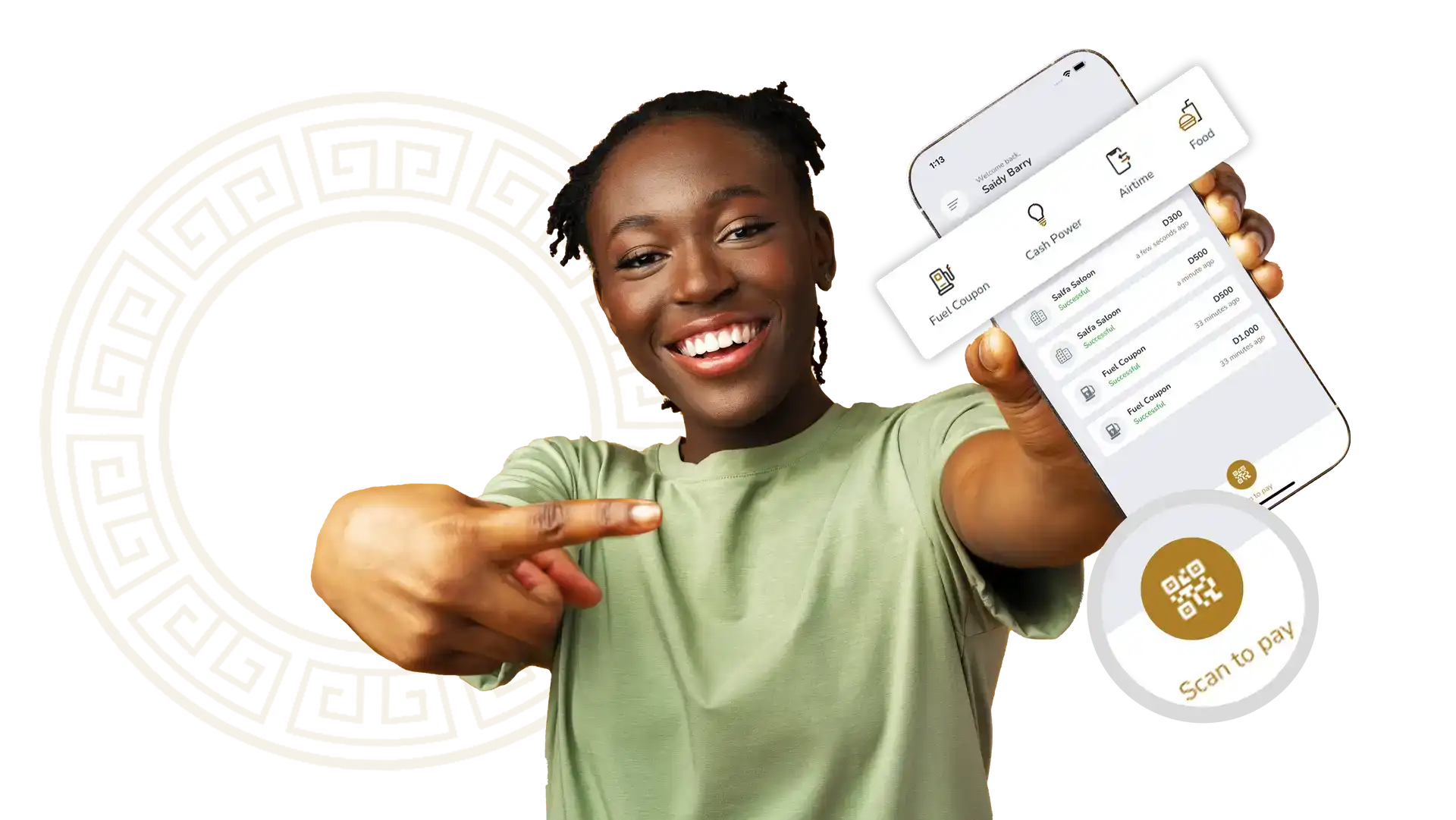

At Waychit, as a stakeholder in The Gambia’s fintech ecosystem, we envision a future where startups, regulators, and established players engage in an ongoing dialogue to ensure that regulation serves as a catalyst for innovation and growth. By doing so, we can create a vibrant and inclusive financial future for all Gambians.

Fintech

Regulation